Foundations of strategy

Blue Apron Market Strategies & Competitive Advantage

Company Background

Blue Apron offers an alternative option to traditional cooking by delivering fresh ingredients and recipes to the doorstep of it’s customers. Founded in 2012, the company exclusively operates in the United States, selling weekly boxes of high quality, sustainably grown ingredients to be cooked at home. The company hopes to build emotional human connections formed from customers’ cooking experiences. In June 2017, Blue Apron went public, making them the first U.S. meal-kit company to do so. However, as the competition increased, Blue Apron found themselves struggling to keep their business in the meal-kit industry. As a consequence of going public, the need for new customer acquisitions has been increasing exponentially causing high marketing spend.

The Meal Kit Industry

The meal-kit concept was first employed in 2007 by the Swedish company Middagsfrid. However, the industry did not make its way into the US until 2012, when Blue Apron, HelloFresh, and Plated entered the market. These three companies have spearheaded the growth of the meal kit industry, accounting for a combined 74.4% of market share (Molla).

Since 2012, the meal kit industry has grown to a $2.2 billion industry. The industry’s average customer spent $617 during the first year subscribed to the company (Molla). However, this number has gone down in recent years. Following the IPOs of some of the industry’s biggest constituents, the industry has seen some decline associated with a lack of customer retention and profitability issues. With the current landscape of the industry, profitability is an issue the industry may continue to experience.

One of the biggest barriers to profitability is the power that buyers hold over meal kit service providers. A large reason that buyers hold power over firms in the industry is that the industry does not fill a need, and it is a service that only certain customers want. Therefore, firms in the industry have to spend large sums of money on marketing to convince consumers that they would benefit from this service. Recently, Blue Apron reduced its spending on customer acquisition, and as a result, saw a decline in its number of customers. The necessity to spend a lot of money marketing the product due to the power of buyers inhibits the ability of firms to convert sales into profit. Therefore, the power buyers have over the firms in this industry makes it hard for firms to be profitable.

The only true power struggle between suppliers in the industry lies in the recipes firms use for the meal kits. The recipes are often provided by well-known chefs, and companies use this point as a marketing tool. Because of the acclaim these chefs have and the premium they command, firms in the industry spend a lot to retain their chefs and use their recipes. However, many recipes may also be simple recipes from online or other sources, which reduces the power of suppliers in the industry. So while the power of suppliers is somewhat high, there are ways for firms to reduce that power by taking certain steps.

The threat of entry to the industry is high, as evidenced by the entrance of 150+ new meal kit companies into the market in the past few years (DeLoatch). With no proprietary information, low capital requirements, and no switching costs for buyers, it is no surprise that many firms are entering into the meal kit business. To add to this, the industry may even expect to see a few restaurants entering the meal kit business in the near future due to their supply-side economies of scale and as a way to mitigate business lost to meal kits.

As previously evidenced, the extent of rivalry in this market is very high. Blue Apron may have been one of the first companies in the market, however, since then the market has been saturated with new competitors. Many niche meal kit companies have entered this space as well. Sun Basket offers organic, paleo, and gluten-free meal plans. Purple Carrot caters to its vegan consumers. Meals from Takeout Kit last longer and don’t have to be cooked right away, giving customers more flexibility in when they choose to make their meals. Gobble is addressing a common complaint many people have with meal kits which is the amount of time spent cooking and cleaning. They advertise that their kits can be prepared in 15 minutes with one pan. Companies that want to enter this industry have realized that there are many incumbent firms that offer to fill the same consumer desires and see the need to differentiate themselves.

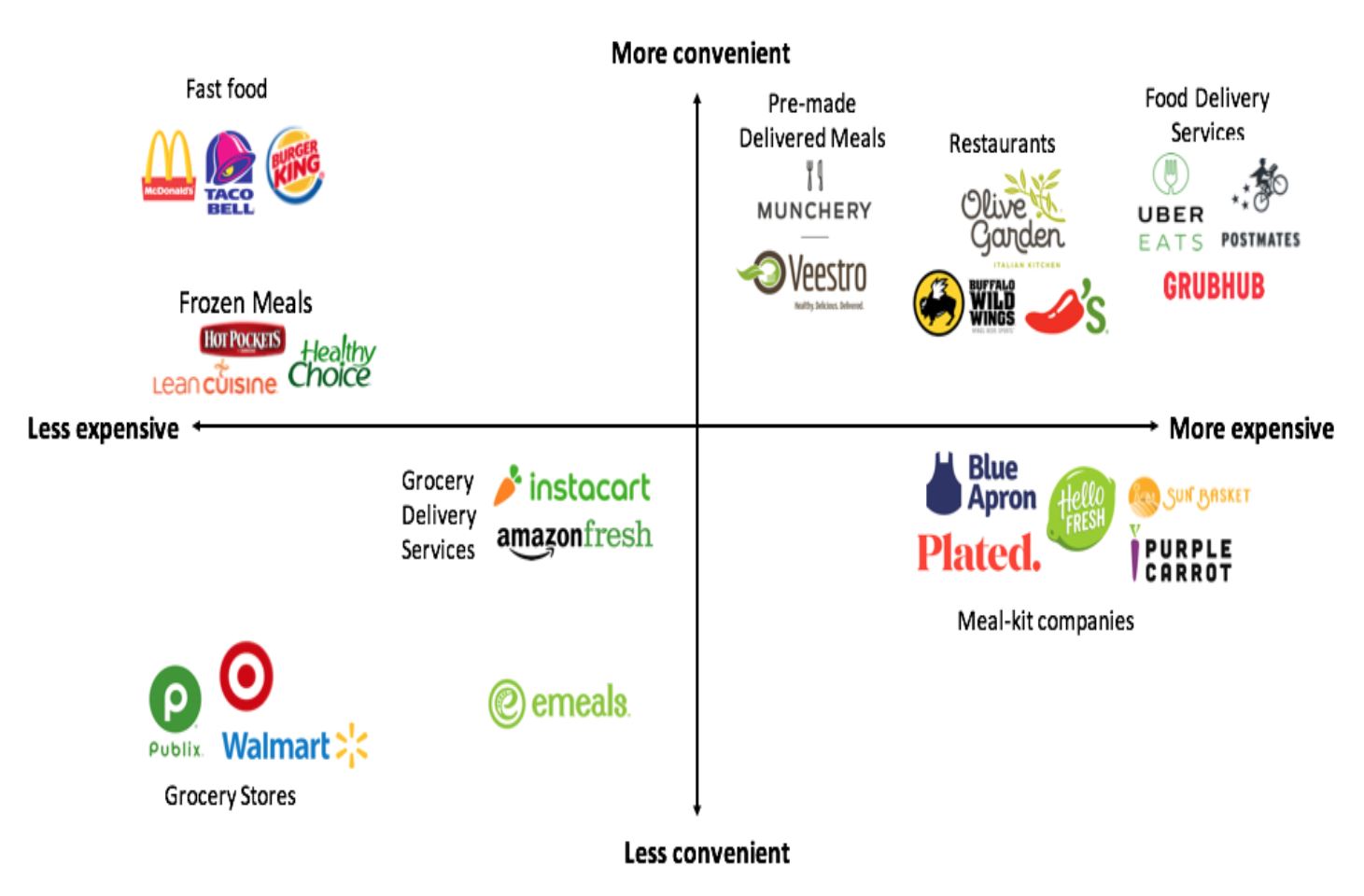

If the number of competitors already in the market isn’t enough, the threat of substitutes to the industry is also extremely high. Meal kit companies target busy individuals and families with the promise of convenience, but they aren’t the only ones picking up on this trend. There are plenty of other options that offer it as well, and many do so at a cheaper price. Grocery stores offer curbside pickup and delivery services through their own platforms or through companies like Instacart. Customers can also use Instacart to get groceries delivered straight to their door, or they can use Amazon Fresh, where they can also order anything else they may need besides ingredients Amazon, all on one website. Restaurants are arguably more convenient for some – no cooking, no cleanup – and entrees can be had for around the same price as a one meal kit serving. Fast food restaurants are even quicker, and cheaper, though they may not be as healthy (although even that is changing). There are also many food delivery services such as Uber Eats, GrubHub, Doordash, Postmates, etc. that consumers can instantly order a fully-cooked meal from without having to leave home. For more health-conscious consumers, companies like Muncher and Veestro have a similar model to Blue Apron, focusing on healthy foods delivered to your door, however, the difference is that these meals come already prepared. And finally, for consumers who like the concept of Blue Apron, but don’t want to pay $10+ serving, eMeals offers a subscription which allows consumers to pick a meal plan, access new recipes, and buy the groceries themselves, either by going into the store or picking them up curbside.

Customer Acquisition vs. Customer Retention

Blue Apron’s 2017 IPO and subsequent struggles have revealed a glaring issue in the industry: customer retention. Blue Apron and other meal kit companies are losing money because they are unable to keep their customers. Because Blue Apron and other similar companies are currently not profitable, they must acquire more customers than they lose in the hopes that the revenue from these customers outweigh its costs. However, this strategy is flawed because acquiring new customers is so costly, and many new customers don’t stay for very long.

To gain a sense of the issue of the cost of customer acquisition, it is helpful to look at some of Blue Apron’s numbers. First, it is estimated that Blue Apron has a churn rate of 72% within six months of subscribing to the service. This means that Blue Apron must replace more than 72% of its customer base every six months in order to keep growing. Because customers are less likely to re-enlist in the service after leaving, the pool of potential customers is gradually growing smaller. This poses a serious long-term viability issue to Blue Apron. Perhaps the most alarming number is that Blue Apron loses money on 70% of its customers – 70% of Blue Apron’s customers will not spend enough money to outweigh the money Blue Apron spent acquiring them. If this is the case, Blue Apron needs to build a devout customer base that will spend enough to outweigh the losses from the other 70% (McCarthy).

Thus, a strategy focusing on high customer acquisition is not a viable option for Blue Apron, as it is unlikely to ever achieve profitability when pursuing this strategy. Retaining customers, on the other hand, is relatively cheap. Firms such as Wal-Mart and Amazon do not have to spend much money to retain customers because their business model does it for them. If Blue Apron can increase its customer retention, then it will allow for future profitability.

The majority of Blue Apron’s marketing spend goes to customer acquisition. They use various online and offline channels, in the form of ads through TV, mail, radio, podcasts, and sponsored reviews in order to appeal to as many people as possible. Also, they spent $35M on their customer referral program alone. Data shows that the company is spending over $400 to acquire a new customer, but only sees quarterly revenue of about $236 per customer (Taylor). This strategy may help them boost their subscriber numbers in the short run, however, it is very clear that it will not be viable for profitability in the long run.

Strategic Question

Blue Apron is having a hard time keeping their foothold in the market; their share of the market has been declining, and as of March 2018, Hellofresh has taken the lead with 36% of the market, and Blue Apron has fallen to second with 35% (Mola). What can Blue Apron do to establish a competitive advantage and an identity in the market?

Proposed Solution

Blue Apron has had issues with losing market share to competitors as well as being unable to retain customers. For these reasons, they should switch from a low price strategy to a premium product strategy. Although this will limit their scale and customer base, it will allow them to turn a profit. If they can find a group to target and serve them well, they will find a loyal group of customers, limit excessive spending on marketing and customer acquisition, and focus on customer retention. One way in which they can do this is by shifting their service from what it currently is to an at-home cooking class experience.

Blue Apron has realized that the value of the cooking experience is greater than any convenience they can offer; the new strategy leverages this consumer preference. The recipes the customer could choose from for the first few weeks would be easy, and they would get harder as the customer moved along the program. Online tutorials of the chefs cooking the dishes would help them learn what they need to do. This strategic pivot now taps into the need of learning how to cook; instead of trying to convince consumers that having groceries brought to their doorstep makes the cooking experience more convenient, they can easily communicate the value of a learning experience. In addition, because this plan is personalized and each customer will become invested in the program, this creates switching costs. It will be harder for the customer to change to HelloFresh or another competitor when they know that Blue Apron knows exactly what skill level they are.

In implementing this idea, Blue Apron should immediately cut back on customer acquisition, as it is losing money through this strategy. However, they should also roll out the cooking class programs as an additional service to the meal kit service. Through this, Blue Apron could determine the size of the market for an improved service. Over time, as Blue Apron reduces its immense marketing attempts, more loyal customers should begin to emerge, and Blue Apron can focus on additional strategies to earn greater profits off of those loyal customers. Introducing this as a complementary service to the existing meal kit service will eliminate a large portion of the risk associated with taking on this strategy shift.

There may be push back to this strategy, particularly through Blue Apron’s shareholders, who could be concerned with the lack of scale and implementation of the strategy. However, its current business model brings the long-term viability of the company into question due to the lack of profitability. A new business model that provides shareholders with a clear path to profitability should cause optimism by shareholders, even if it limits Blue Apron’s ultimate size. Furthermore, despite the appearance of a drastic change in the business model, Blue Apron should be able to leverage its hinge capabilities such as its large existing subscriber base, production facility in New Jersey, and large capital base to effectively implement this new strategy.

While this recommendation does not come without risks and doubt from Blue Apron’s stakeholders, it addresses Blue Apron’s biggest flaws: differentiation and customer retention. The new strategy will make Blue Apron substantially differentiated from its competitors, and it should build switching costs for those customers enrolled in the new service. Furthermore, it should incentivize customer loyalty and repeat business, which should help Blue Apron tackle customer retention. In the end, the strategy could cause an initial reduction in revenue but should ultimately generate profit.

Sources

DeLoatch, Pamela. “Investors Say ‘No Thanks’ to Another Helping of Meal Kits.” Food Dive, 8 Jan. 2018, www.fooddive.com/news/grocery–investors-say-no-thanks-to-another-helping-of-meal-kits/514346/.

McCarthy, Daniel. “A Detailed Look at Blue Apron’s Challenging Unit Economics.” LinkedIn, 27 June 2017, www.linkedin.com/pulse/detailed-look-blue-aprons-challenging-unit-economics-daniel-mccarthy.

Molla, Rani. “Blue Apron Still Dominates the Market for Meal Delivery Kits but Its Market Share Is Plummeting.” Recode, Recode, 1 Nov. 2017, www.recode.net/2017/11/1/16581142/blue-apron-market-share-decline-meal-kit-delivery-hello-fresh.

Molla, Rani. “HelloFresh Is Now Bigger than Blue Apron in the U.S.” Recode, Recode, 26 Mar. 2018, www.recode.net/2018/3/26/17165030/hellofresh-blue-apron-meal-kit-delivery-marketshare-acquisition-organic-green-chef.

Richter, Dominik. “HelloFresh Knocks up a Recipe for Sales Growth.” Financial Times, 24 Apr. 2017, www.ft.com/content/23e58f22-0a3e-11e7-ac5a-903b21361b43.

Taylor, Kate. “Blue Apron Is Spending More than $400 for Every New Customer – and That’s Creating a Major Problem for the Company.” Business Insider, Business Insider, 7 Aug. 2017, www.businessinsider.com/blue-apron-spends-big-for-new-customers-low-return-2017-8.